This week, we’re keeping an eye on three major stocks that are reporting earnings. Two of them have been beaten down and are looking to turn things around, while the third has had a tremendous run and is looking to keep its extraordinary momentum going. Let’s take a closer look at each one. Could FedEx Be Ready for a Comeback? ...

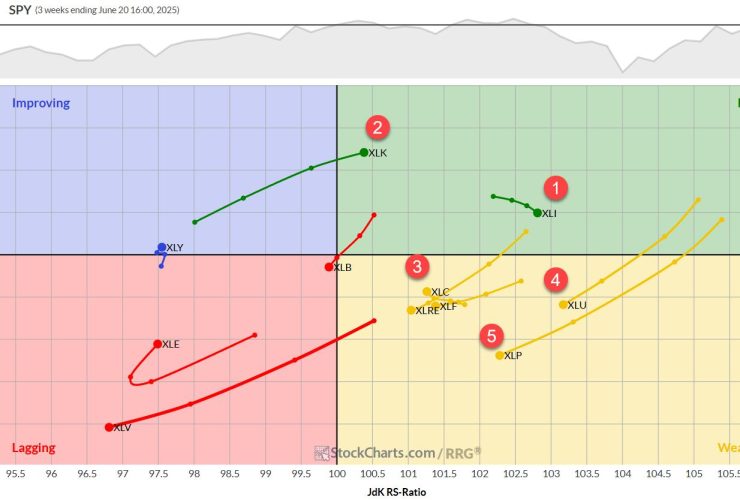

Some Sector Reshuffling But No New Entries/Exits Despite a backdrop of significant geopolitical events over the weekend, the market’s reaction appears muted — at least in European trading. As we assess the RRG best five sectors model based on last Friday’s close, we’re seeing some interesting shifts within the top performers, even as the composition of the top five remains ...

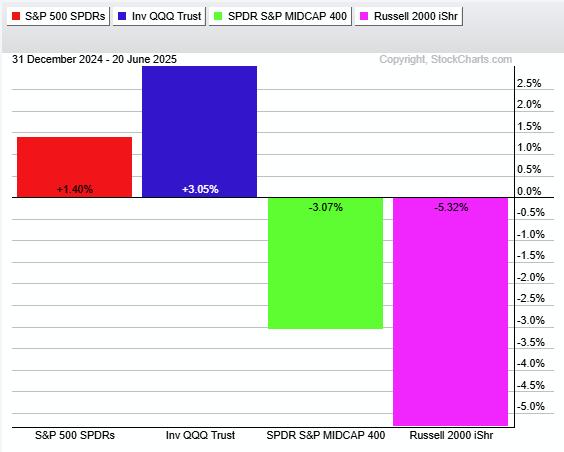

The S&P MidCap 400 SPDR (MDY) is trading at a moment of truth as its 5-day SMA returns to the 200-day SMA. A bearish trend signal triggered in early March. Despite a strong bounce from early April to mid May, this signal remains in force because it has yet to be proven otherwise. Today’s report will show how to quantify ...

In today’s “Weekly Market Recap”, EarningsBeats.com’s Chief Market Strategist Tom Bowley looks ahead to determine the likely path for U.S. equities after the weekend bombing of Iran nuclear sites. Are crude prices heading higher? Will energy stocks outperform? What additional roadblocks might we have to negotiate after the latest Fed meeting and policy statement? Could we see fallout from June ...