The past week has been relatively stable in terms of sector rankings, with no new entrants or exits from the top five. However, we’re seeing some interesting shifts within the rankings that warrant closer examination. Let’s dive into the details and see what the Relative Rotation Graphs (RRGs) are telling us about the current market dynamics. Sector Rankings Shuffle The ...

I like to trade stocks that are relative leaders and belong to industry groups that are leaders as well. For the past 2-3 months, much has been written about and discussed with respect to semiconductors ($DJUSSC), software ($DJUSSW), electrical components & equipment ($DJUSEC), electronic equipment ($DJUSAI), recreational services ($DJUSRQ), travel & tourism ($DJUSTT), etc. These groups were laggards prior to ...

After a strong move in the week before this one, the Nifty spent the last five sessions largely consolidating in a very defined range. The markets traded with a weak underlying bias and lost ground gradually over the past few days; however, the drawdown remained quite measured and within the expected range. As the markets consolidated, the trading range got ...

This holiday-shortened week was anything but short on action! The S&P 500 and Nasdaq Composite closed at record highs, but what is really driving the market? In this essential recap, expert Mary Ellen McGonagle dives into the sectors and stocks making big moves. She’ll reveal why energy and financial stocks are heating up, discuss the surge in biotech and regional ...

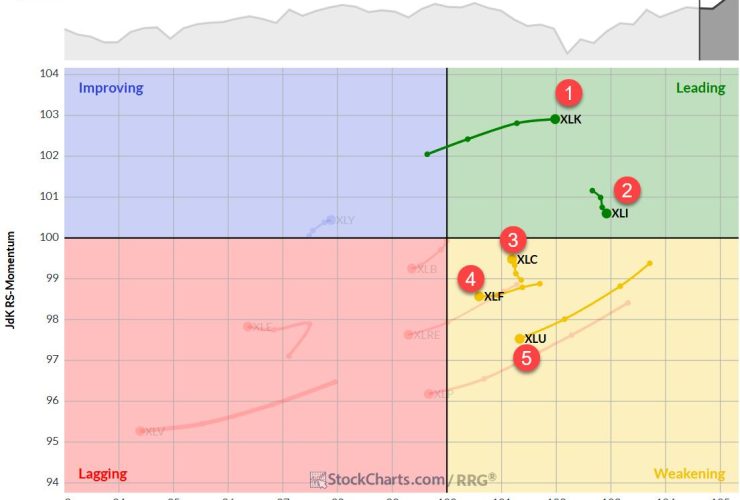

Feeling a little anxious about the market, even with a strong economy? The truth is, money isn’t fleeing the market; it’s simply moving around, creating fresh opportunities. In this must-watch video, Tom Bowley of EarningsBeats eases those anxieties by providing charts that show this rotation. Tom shows clear signals of broad market participation, digging into the performance of key areas ...

Stocks keep notching record highs. If you’re like most investors, you’re probably wondering, “Should I really chase these prices or sit tight and wait for a pullback?” Instead of overthinking and ending up in Analysis-Paralysis land, however, it may be worth exploring other avenues — and maybe even something you’ve never thought of. Enter bearish counter-trend options strategies. Yup, it ...

This week, Frank analyzes recent technical signals from the S&P 500, including overbought RSI levels, key price target completions, and the breakout potential of long-term bullish patterns. He examines past market breakouts and trend shifts, showing how overbought conditions historically play out. Frank also walks through a compelling mean-reversion trade idea in Apple, emphasizing its lagging performance and potential rebound ...

Roblox Corporation (RBLX), the company behind the immersive online gaming universe, has been on a strong run since April. This isn’t the first time the stock demonstrated sustained technical strength: RBLX has maintained a StockCharts Technical Rank (SCTR) above 90, aside from a few dips, since last November. Currently, RBLX is showing up on a few scans that may signal ...

Joe presents a deep dive into MACD crossovers, demonstrating how to use them effectively across multiple timeframes, establish directional bias, and improve trade timing. He explains why price action should confirm indicator signals, sharing how to identify “pinch plays” and zero-line reversals for higher-quality setups. Joe then analyzes a wide range of stocks and ETFs, from QQQ and IWM to ...

Join Grayson for a solo show as he reveals his top 10 stock charts to watch this month. From breakout strategies to moving average setups, he walks through technical analysis techniques using relative strength, momentum, and trend-following indicators. As a viewer, you’ll also gain insight into key market trends and chart patterns that could directly impact your trading strategy. Whether ...