Bitcoin ($BTCUSD) is riding a wave of surging optimism, smashing past $112k as retail and institutional capital pour into the cryptocurrency. Some say the market has grown euphoric, and that a sharp pullback may be lurking around the corner. Others believe this is just the beginning of another leg higher. A few key questions to guide your analysis: What does ...

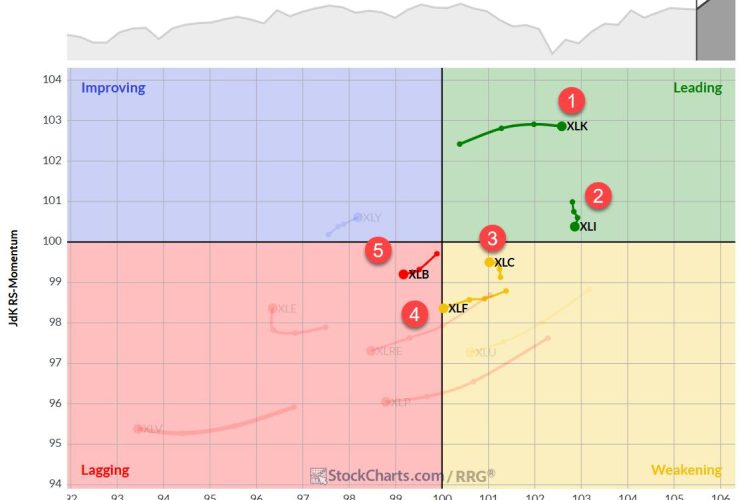

After a relatively quiet week for the S&P 500, we’re seeing some interesting shifts in sector dynamics. Let’s dive into the latest rankings, RRG analysis, and what it means for our portfolio strategy. Sector Shifts and RRG Insights: Materials on the Move The big news this week is the ascent of the Materials sector, which has muscled its way into ...

I remain very bullish and U.S. stocks have run hard to the upside off the April low with growth stocks leading the way. I expect growth stocks to remain strong throughout the summer months, as they historically do, but we need to recognize that they’ve already seen tremendous upside. Could technology (XLK) names, in particular, use a period of consolidation? ...